H1 2025 Portfolio Review

Portfolio update in H1 of 2025. Current allocations, new positions taken, and how I'm positioned for outperformance.

Disclosure: I may add, reduce, or sell any position without notice. This portfolio is strictly informative, includes my opinions and does not constitute as financial advice. Please do your own due diligence.

The first six months…

have been volatile. Characterized by Trump tariffs, abrasive global relations, pressure to ease tensions across Israel / Palestine, Russia / Ukraine, and India / Pakistan. All while tariff deals are being negotiated…

Coming into 2025, the portfolio was positioned to high beta names like Talen Energy (TLN), META, and Nebius Group (NBIS). As expected, “Liberation Day” sent a shockwave through markets, where beta was punished. No positions were liquidated, and names like TLN, NBIS, and TSSI were added to, in the dip. This turmoil didn’t persists longer than 30 days, as the world remembered that an AI / compute revolution was taking place, and eventually the market recovered.

1H Performance: Money-weighted IRR: 23.7%

1H SPY Performance: 5.37%

Since Inception: 3.5 Year MW-IRR Compounded: 50.66%

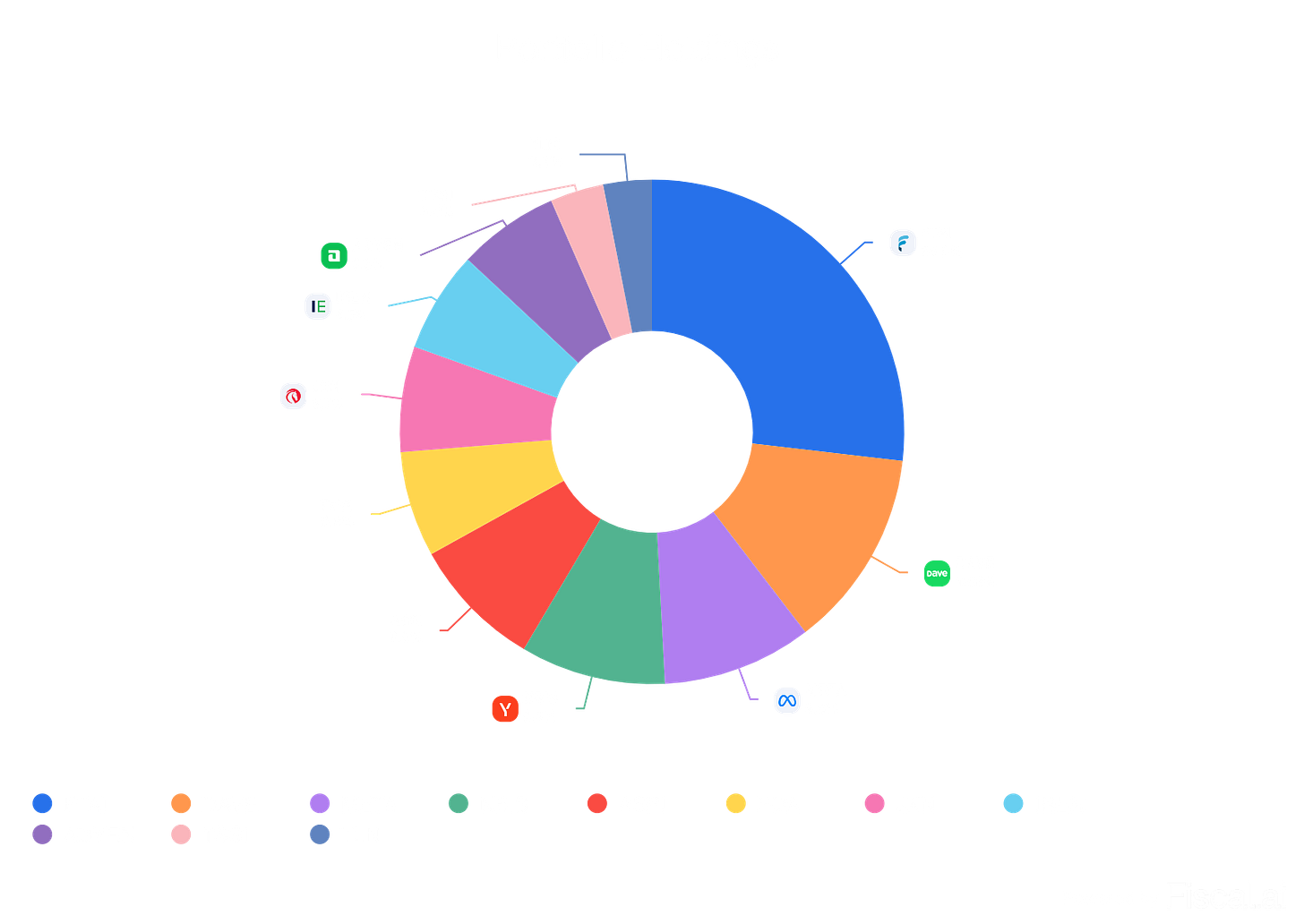

At the 1st half mark, I hold 11 positions, 100% long, no short, with no options. With 3.5 years of investing track record under my belt, I have compounded at a 50.66% money-weighted IRR. I am very proud of my current pace, but know it is not sustainable, as my asset size grows incrementally. I maintain the same attitude that “great” ideas are very scarce, and if I’m lucky, and can concentrate on 5-6 great ideas, that will drive outperformance. I am still forecasting and evaluating investment ideas through a 24-month timeframe.

Prior to Liberation day, I made the choice to cut my losses with my 2nd largest position exiting 2024, Canadian steel manufacturer, ADF Group (~20% weighting). I felt that changes in policy sentiment toward Canada could make my position a very poor risk / reward. This proved to be a good decision, as it crashed -30% on tariff news. Management not only mis-read the bullish tailwinds of the steel market in bidding for contracts, but U.S. tariffs on steel proved to be devastating to the industry.

Current State:

Talen Energy (TLN) will soon be liquidated entirely, a 100%+ return in 9 months. Much of this capital has been devoted to my new 2nd largest position in DAVE Inc (DAVE). I will devote a separate write-up to characterize this company, that’s moved up to a ~13% allocation. Additionally, a 150% YTD return from TSS, Inc. (TSSI) and a 90% YTD run from Nebius (NBIS) have contributed to my outperformance, on the backs of the AI / compute revolution (which I view as much more than just a trend).

FTAI Aviation (FTAI) has dominantly become my largest position. I believe this is one of the fattest pitches I’ve seen in the 3.5 years I’ve been investing, with very defensible and expanding competitive advantages. FTAI continues to take market share, consolidate the industry, while trading at a measly 6x NTM Adj. EBITDA. See my latest writeup for a deep dive… this one’s special.

ASP Isotopes (ASPI) has nearly tripled in allocation, as multiple catalysts have been set in motion. A customer has validated the efficacy of their HALEU solution, as TerraPower signed a definitive agreement for a 10-year supply of enriched uranium. Effectively, disproving the claims of short-seller, Fuzzy Panda. After this announcement in May, I doubled the position, having previously believed the technology was there… this contract reaffirmed it.

Despite being difficult to evaluate, as a “black box”, everyone who’s visited their facilities in South Africa have affirmed my beliefs about the company, their patented tech, and how scalable their manufacturing is. Despite this being a manufacturing company, it’s surprisingly asset light, with CapEx commitments being invested up-front, at ~$25M per facility.

CEO, Paul Mann has skin-in-the-game, and is well incentivized to succeed. ASPI will be producing revenue from Carbon (C-14) in 2025 for medical and pharmaceutical research. Ytterbium (Yb-176), for cancer therapy and medical imaging should be available for sale in 2025 via their South Africa facilities. Additionally, they will be delivering their first Silicon (Si-28) production in Q2 ‘25, and will have a new facility to ramp production, that will be ready in 2026. Although sales won’t be significant this year, 2026 is when they begin to scale incrementally. ASPI kicks off a 4-year commercial supply agreement for Gadolinium (Gd-160) for cancer radiotherapies.

Many catalysts still exist like a dual listing for improved liquidity, more contracts being announced, new facilities coming online early, and the eventual spin-off of: Quantum Leap Enrichment (QLE), the subsidiary that will produce HALEU. I remain very long ASPI, and am very confident that the next 12 months will look different from the last.

Two new positions have been taken in Jackson Financial (JXN) and Finance of America (FOA), tied to the same “silver tsunami” thesis (shoutout Unemployed Value Degen). This name is in reference to the boomer generation and their greying hair. As this generation ages, they are commonly very risk averse, and have much of their wealth tied up in their homes.

Finance of America (FOA) is a direct play on home equity, as a reverse mortgage originator. As the boomer generation ages, culturally, they don’t believe in passing down their money or homes to their family. Given the fact that they’re sitting on an estimated 50% of all home equity in the United States, they can leverage the equity in their homes to provision a reverse mortgage, and receive a monthly check to live out their glory days buying an RV, taking cruises, and having in-house medical care. This micro-cap was a former SPAC, and provides a very niche service that is not yet popular in the mainstream. As a result, I believe it’s very overlooked and mis-priced, offering long tailwinds for growth, a very asset-light model, with capital return to shareholders in the near future. I am long, and see 100%+ upside in the next 24 months as they continue to perform during earnings, more liquidity will flow to the name, and more education will take place.

Jackson Financial (JXN) is the leader in variable and Registered Index-Linked Annuities (RILA’s) in the United States. Another beneficiary of the boomers, JXN ties the risk-averse appetite of this generation into a financial product that mirrors the S&P 500 index, while providing hedges to volatility. As a result, RILA’s don’t benefit from the same returns that markets can produce in a year, but also mitigates the volatile swings downward. Earnings growth occurs tax-free until withdrawal, typically during retirement. Thus, making these products very sticky and popular choices among the boomers and overall risk-averse clients, with the goal of keeping them invested in the market. This business screens awkwardly, as the hedges they employ inflate GAAP net income gains and losses, discouraging investors to look deeper. However, management is very conservative, has a strong track record, and is very consistent in returning capital via dividends and buybacks, as this business produces an insane amount of free cash flow. Due to its abnormal reporting, Jackson trades at an astoundingly cheap 4.5x NTM earnings, opting to return massive FCF via buybacks. Although JXN is out of favor with the market now, I believe a re-rating is imminent. This may take a few years to materialize, but they will keep spitting out cash and returning it in capital efficient ways. I also see 100%+ upside for JXN in the next 24 months.

Lastly, I have added to 2024 position, IREN Limited (IREN), as a data center play that continues to be mis-priced, and falsely valued as a Bitcoin miner. I feel confident that market perception will change before the end of 2025, as there’s a notable retail following, and growing coverage to educate the market. Many catalysts are around the corner, 50 EH/s of mining capacity (just achieved), the completion of Sweetwater, and a co-location agreement signed. I will likely continue adding to this position, as I expect well beyond 100% returns in the next 24 months.

Thanks for reading, and consider subscribing if you want to keep up with my work through Substack, or your email inbox.

God bless.

Nice work!