2023 In Review: Investment Lessons & Reflections

Two years in... so far, so good. Here's how I'm beating the index by a +40% delta.

Happy Sunday.

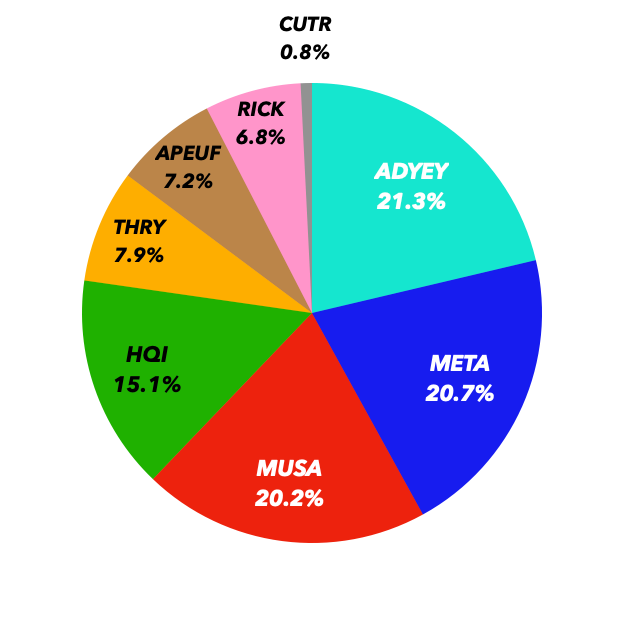

Today I’ve decided to share my portfolio as we approach the end of 2023. This has been an outstanding year, both for performance and development in my 2nd year investing. As those who follow my write-ups know, I prefer to run a highly concentrated portfolio. And have stayed true to this core philosophy, despite the ungodly number of “exciting pitches” I see Mr. Market throwing.

The MicroCap sector is a space I’m devoting much of my attention to, as I see it littered with unique opportunities, both in the U.S. and overseas. But stated in my first writeup, I don’t believe in tribal sector restrictions when investing. This has enabled me to change my mind when a thesis changes, or re-focus when I see another vertical providing cheaper multiples. Additionally, the ability to pivot based on sector has enhanced my sense of urgency when a perceived “fat pitch” arises! Now for the reveal… here’s my portfolio as of December 2023:

Portfolio Positions:

$ADYEY - 21.3%

$META - 20.7%

$MUSA - 20.2%

$HQI - 15.1%

$THRY - 7.9%

$AEP.V - 7.2%

$RICK - 6.8%

$CUTR - 0.8%

Although I don’t have write-ups on every business in my portfolio yet, I want to address some of these names in the new year. My substack is a way of tracking my investment thesis’ to ensure I’m kept accountable for any actions taken (ideally very few).

Performance:

Since inception, the portfolio has performed: +37%, while the S&P has done -3%, driving a +40% delta in the last two years:

2022: SPY -20%, my results: -10%

2023 YTD: SPY +17%, my results +47%

Final Thoughts:

As we move into 2024, I look forward to finding new opportunities regardless of size to distance myself from the index. I am confident in the names I’m invested in, and believe that I’m getting incrementally more analytical and creative every 100 hours I dedicate to this craft. Thank you for your support, and have a warm holiday season.

God bless.