Why FTAI Aviation ($FTAI) Presents a Rare Opportunity

Current "battleground" stock that's suffering from a deceptive short-report. Structurally advantaged co. with what I believe is 100%+ upside in 24 months.

Disclosure: At the time of writing, I own a significant position of FTAI in my portfolio. I may add, reduce, or sell my position without notice. This write-up is strictly informative, includes my opinions and does not constitute as financial advice. Please do your own due diligence.

What I’m Drawn To:

Predictable, recurring, long contracts with sticky maintenance services

Simple, cost and time effective go-to-market for airlines with few competitors that provide vertically integrated maintenance servicing

FTAI is a large beneficiary of Boeing and Airbus’ production issues, making current engine supply more prone to maintenance overhaul

Skewed supply / demand dynamics provide FTAI with strong pricing power and ability to pass on price hikes from aircraft OEM’s

Aircraft lessors tend to shy away from MRO facilities, given their lack of expertise and personnel… making barriers to entry high

Potential for more FAA approved Parts Manufacture Approvals (PMA), driving further margin expansion for module swaps and growing competitive advantages

Associated Risks / Pre-Mortem:

A much improved supply chain, with in an increase of engine supply, likely deteriorating margin profile and demand for services

More airlines and competitors (aircraft lessors) building or buying their own aircraft MRO shops, in an attempt to vertically integrate

Consumer air travel falling off a cliff

The currently skewed supply / demand imbalance correcting itself faster than anticipated

Another global crises like COVID, incentivizing airlines to avoid using much of their fleet to save and cannabalize maintenance costs

I feel this is the right management team today at 5% market share… but is it the right one to scale to 15% industry market share?

Will they have enough human-capital to service the engines / modules to scale market share past 15%?

Business Overview:

FTAI Aviation or “FTAI” own and exchange aviation equipment that’s sold, leased, repaired or maintained at facilities in Miami and Montreal. There are two reportable segments that make up the business:

Aerospace Products (AP)

Aviation Leasing

Reportable Segment 1: Aerospace Products (AP):

This segment, 1. provides engine maintenance for CFM56 and V2500 engines via the Maintenance, Repair & Overhaul (MRO) facility. 2. provides a 526,000 sq. ft “module factory” for modular engine repair and replacement of CFM engines. And 3. offers FAA-approved aerospace parts through a joint venture.

There are two MRO facilities, the QuickTurn Engine Center in Miami (acquired in 2023) and a 300,000 sq. ft. Lockheed Martin Commercial Engine Solution facility in Quebec (acquired in 2024). Both provide engine maintenance for the most common engine in global air travel, the CFM56. This engine makes up ~40% of the world’s fleet, an estimated 21,000 engines (as of 2024). The CFM goes on all Boeing 737 series models, and Airbus A320 family. This engine is very modular, and can be thought of as three engines in one, based on GE and Safran’s design. FTAI also services the 2nd largest engine block, the V2500, that makes up ~11% of aircraft engine market share. The MRO facility was designed to outsource maintenance services for airline fleets with a capacity of 1,350 overhauls, 3 engine test cells and 500 engine tests a year.

^ Example of an engine test cell ^

The second component of “Aerospace parts” is the module factory, which is connected to the MRO facility in Quebec. This 526,000 sq. foot specialized facility was intended for swapping entire engine modules, as opposed to maintenance of specific parts, that MRO handles.

When an aircraft comes in for repair, they require either a “hospital shop” or “heavy shop” servicing. Hospital shop trips tend to take under 30 days, are often too complicated for an airline field servicer to handle, and don’t require an entire engine overhaul. Whereas, a heavy shop visit requires significant disassembly of an engine. Most or all Life Limited Parts (LLP’s) are inspected, cleaned or replaced, in this case.

The modular design of the CFM makes it a prime candidate for interchanging entire modules in this manner. FTAI provides customers the flexibility to pick either 1, 2 or 3 module replacements (3 is an entire engine). Therefore, airlines save money exchanging the engine through FTAI over an OEM, they save in avoiding expensive heavy shop visits, and reduce aircraft downtime to a minimum. In the Q2 ‘24 earnings call, FTAI claimed the average engine turnaround time is ~120-180 days in this market, where module swaps can be completed on average in 5-25 days. In other words, the module factory allows FTAI to offer the detail and completeness of a heavy shop visit, in the window of a hospital shop visit.

Additionally, based on recurring nature of their contracts, FTAI knows how many aircraft they will need to service in the near future, enabling them to pre-build CFM engine sets. Providing an airline the flexibility of having an engine replacement year-round, with services customizable for an entire fleet, found in MRO. FTAI can also flex their pricing power, as they charge OEM rates per contract hour, which airlines willingly commit to, given the much shorter turnaround time.

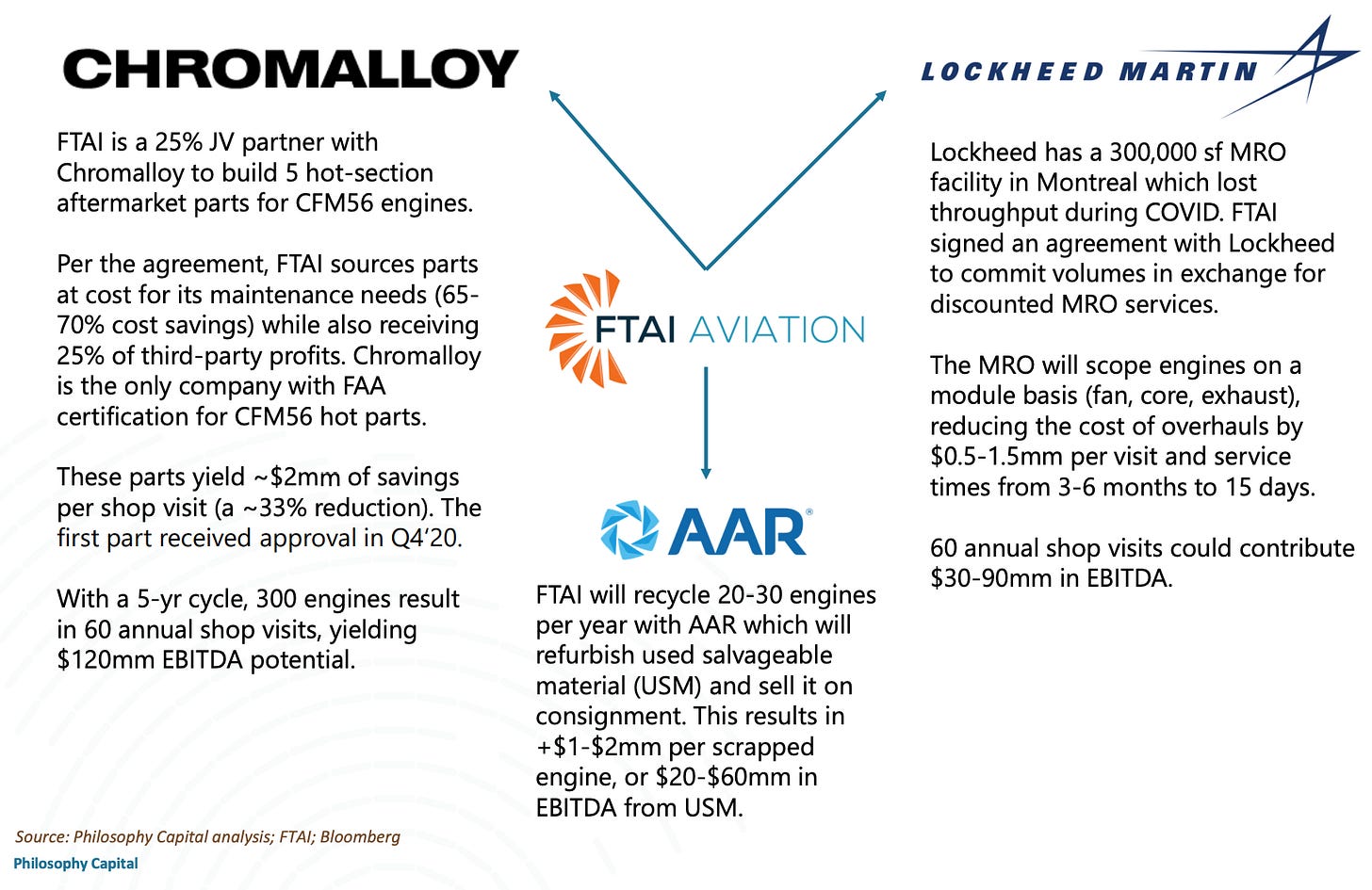

Finally, FTAI has an exclusive joint venture, for Parts Manufacture Approval (PMA) with Chromalloy, an aftermarket parts manufacturer. FTAI is able to source aftermarket parts ~60-70% cheaper than OEM’s, in exchange for 25% of their sourced profit to third parties. FTAI also receives exclusive access to FAA approved modules, which Chromalloy will supply and manufacture. This partnership cannot be understated, given Chromalloy is the ONLY company to receive FAA parts manufacture approval extending to both: low pressure turbine blades (approved in 2021) and high pressure turbine blades (approved in 2024). They are working to get 3 more parts approved by the FAA, which take an average of 3-5 years to test and gain approval. Despite the grueling timeframe, this commitment creates a substantial barrier to entry, and competitive edge if a competitor seeks to recreate this relationship with a rival manufacturer.

Additionally, FTAI shares a partnership with AAR to recycle a percentage of engine Used Serviceable Material (USM) of CFM56’s to meet the carbon reduction act (CORSIA). As a benefit, FTAI receives kickback from engine scrap and USM, a small addition to EBITDA.

^ Image from *2021 Philosophy Capital Presentation ^

Ultimately, this segment enables FTAI to act as an alternative to OEM-based part production and distribution. This has proven to be timely and lucrative, as the supply / demand imbalance has become exacerbated, with OEM’s struggling with production, supply chain bottlenecks, lawsuits from cutting corners, and hits to their reputation.

Reportable Segment 2: Aviation leasing and Acquisition:

The leasing business is rather straight forward, but benefits from long contracts typically inked for 36 months. Additionally, I consider this segment to operate as a customer acquisition cost / extension of the recurring, sticky maintenance services. If FTAI opts to sell an aircraft, a buyer can still retain the MRO services, given the pre-existing relationship with FTAI.

As for inventory, in Q3 ‘24, FTAI owned 442 CFM56, 145 V2500, and 54 standalone engines, for a portfolio of 641. The leasing business extends to both engines and aircraft. When acquiring aircraft from their network, FTAI may purchase the whole bird, but don’t always choose to lease the entire unit. Often, they will opt to sell the airframe, keep the engine, and lease it to customers. An added benefit of being vertically integrated, as when they buy an engine, they can put it in MRO, break up the modules, to repair and refurbish into a mostly new unit.

Given FTAI’s large network, they can buy engines that the market perceives to be unserviceable, while a single CFM module typically results in the block being unusable. Historically, there’s minimal competition, as competitors lack the presence of a module shop, meaning they can’t swap an unserviceable module, enhancing the lifespan of the engine. Instead, they only value the unit based on the parts they’re able to strip, and use in another engine block. Therefore, FTAI can buy a used CFM engine at a significant discount to OEM price. On top of this, aftermarket acquisitions should only grow, as their distribution network does, globally.

Credit to: Banash Capital on X for putting this idea on my radar!

Recent Price Action:

Anyone who looks at the chart in the last 60 days will likely wonder why FTAI fell off a cliff. Recently, short-selling firm, Muddy Waters published what I believe to be a sloppy short presentation without understanding FTAI’s business. I have added significantly at the pull back and believe this is a very rare opportunity. These were the allegations made:

Aerospace Product Sales are Deceptive:

Muddy Waters believes the MRO business is being warped, as growth is driven by one-time, whole engine sales, accounting for ~80% of segment Adjusted EBITDA. They also claim that ~70-80% of module sales are whole engine sales.

This is an example of Muddy Waters simply not understanding FTAI’s business. The module factory enables customers to buy either individual modules or 3, (exchanging the entire CFM engine block). In Q1 ‘24 earnings, management stated that “the average [module factory] transaction averages out to 2”. Given the one-stop-shop value proposition as a service provider, it’s very possible that ~70-80% of module sales are whole engines. However, this is NOT a bad thing, and I believe this is NOT driven by one-time results!

During COVID, airlines parked a large percentage of planes away to save on maintenance CapEx, what is called “cannibalizing maintenance”. As travel backdrops have improved, management has more access to flight utilization to forecast airline maintenance demand. FTAI’s significant growth efforts in the last two years align to travel data indicating that demand radically outpaces the rate in which OEM’s are producing new engines. Therefore, whole (3 module) engine exchanges are becoming more of a cost-effective solution as market imbalance persists, and customers want little to 0 turnaround time. If more customers demand an entire engine exchange, adding a module on average, this will increase incremental EBITDA on the same transaction, a tailwind for margin expansion.

Channel Stuffing:

Muddy Waters makes the claim that FTAI has been exaggerating their results through selling aircraft to pump up financial results. They also claim that by transferring engines from leasing to MRO and back, they are masking true segment Cost Of Goods Sold.

Initially, I thought there could have been some validity to these allegations, however I will direct you to InPractise, who does a stellar job of addressing these meritless claims. In this podcast, they address the process in sourcing engines, engine exchange, Life Limited Parts, and the nature by which FTAI has organically grown their relationships, and sales throughout 2024. Additionally, the market imbalance from OEM engine providers further compounds the belief that MRO demand has increased naturally. Again, it’s reasonable to assume that vertically integrated providers like FTAI would be the largest beneficiary. After all, they’ve managed to hit 2026 financial goals 24 months early, due to this demand.

^ Screenshot from InPractise’ podcast (link in footer) ^

Accounting / Financial Flaws:

Muddy Waters continues with a ticky-tack criticism of FTAI’s depreciation schedule, to optically appear more profitable in the MRO segment. They also questioned how FTAI is 10% more profitable than Boeing and GE Commercial engines.

FTAI has maintained the same auditor since 2015, Ernst and Young. Not only are they very well respected, but have doubled down, re-affirming the 11-13% depreciation schedule of their short-lived assets. It’s important to know that FTAI’s assets that aren’t involved in servicing or leasing are not depreciated. This is a very fair depreciation policy, as they hold assets over expected ~2-6 year lifespans, a policy that’s remained consistent, since their IPO in 2015.

Again, Muddy Waters misses the mark, by failing to understand that asset turnover is nearly 3-4x faster than the average MRO competitor. This leads to lower overhead and subsequently, faster revenue recognition. On top of that, their exclusive partnership with Chromalloy enables them to source aftermarket parts 60-70% cheaper than OEM’s. Making their margins structurally superior, and not comparable to these counterparts.

Former FTAI Insider Confirmation:

Muddy Waters attempts to legitimize his claims by mentioning he’s spoken to an industry insider. Attached is an image of their discussion:

This consultant was supposedly a former FTAI executive who confirmed their beliefs. It’s possible this took place, but is too easy to lie about, given the former employee can hide in anonymity. Until more detailed accounts are released, I will chalk this accusation up to a nothing burger.

My Thesis:

Now that the business has been defined and recent price action debunked, this is how I believe FTAI can continue scaling…

In 2025, the 2nd engine block, the V2500 will play a larger part on growth. In Q1 ‘24 earnings, management addressed how the V2500 is more expensive to service, given less modularity and engineering complexities. Therefore, making it an extremely in-demand engine block to service, as air fleets look for solutions to circumvent heavy shop visits. The V2500 yields higher profit margins, as a result. I believe the V2500 servicing will experience new efficiencies as it makes up a larger % of sales, given we’re still in early days of the program. In Q3 ‘24 earnings, their 100% acquisitions of facilities in Miami and Quebec enable them to save $40-$50M in 2025 internalization, and perhaps even higher in 2026. Lastly, I see the V2500 engine contributing to EBITDA in 2025, that I believe analysts are failing to recognize.

Next, in Q1 ‘24 earnings, expansion to Southeast Asia was discussed as a potential tailwind. Although speculation, I would imagine a facility in China, Japan or South Korea would service an growing level of international demand, and serve as an extension to their growing US demand.

Another significant growth lever is a recent Strategic Capital Investment announcement. Investor meetings with CEO, Joe Adams took place in the first week of January to deploy an outsourced $3 Billion US dollars to complement the leasing and acquisition business and take on further capacity of CFM and V2500 engines. This capital may be devoted to enhancing pre-existing facilities, building or acquiring new facilities, or sourcing and buying used engines aftermarket. From estimates I’ve seen, this program could provide an incremental $200M in EBITDA per annum, which I haven’t fully baked into my projections. Admittedly, there is much to uncover with this growth lever, but it creates a capital-light means of scaling an otherwise fragmented industry in a large demand backdrop.

As top line grows, I believe there are multiple ways to continue growing pricing power and expanding margins. Economies of scale further enhance the power of this business. As FTAI acquires more perceived “unserviceable engines”, their bargaining power, to purchase cheaper than any vendor does, with it. Once engines are acquired, they continually save money from the MRO facility and module factory.

Assuming the Strategic Capital Initiative acts as the acquisition tool, I believe it will, then the flywheel becomes stronger. Not only can FTAI charge OEM rates per contract hour, but they will likely bring more units to the MRO shop, and upsell more modules per aircraft. For each quarter in 2023, each module for a CFM averaged $500k in EBITDA. By Q1 2024, FTAI was charging on average of $600k of EBITDA / module. And today, I believe they yield somewhere above $700k+ in EBITDA per module. As more aircraft is brought into their facilities, their pricing power increases, as does their reach.

Finally, the Chromalloy partnership has created 2 of 5 module approvals from the FAA. However, there are still three total in the works, with management claiming that another approval is around the corner. Unlocking the third module further contributes to their ability to expand margins.

Valuation and Concluding Thoughts:

If it’s not already clear, I think FTAI presents an extremely rare opportunity after the Muddy Waters short report. I already hold an outsized position in my personal holdings at a cost basis of $119 USD / share, and believe this will be a big winner for many years to come.

My projections have FTAI producing around ~$1.6B USD of Adj. EBITDA in 2026. That means they’re trading at less than 8x ‘26 Adj. EBITDA for a business with decade plus tailwinds and growing operating leverage. Given their structural advantages as a vertically integrated vendor, and access to PMA, I think it will one day trade in line with industrial darlings like Heico or Transdigm, at 20-25x EBITDA. Looking out two years, I don’t think that’s a reasonable estimate, but 13-14x EBITDA is. That would imply a 70% multiple expansion. I believe the market will justify it for the following reasons:

1. Organic market share growth, and the deployment of Strategic Capital Initiative accelerating MRE growth, as OEM’s continue to struggle

2. Gaining approval for a 3rd PMA from the FAA, making customers further ingrained in the FTAI product ecosystem

3. The market appreciating annual pricing power given the vertically integrated advantage, as they offer customers a value proposition without alternatives

4. The market realizing that although capital intensive, FTAI can produce large FCF, when they hit scale (my assumption would be ~15%+ market share)

5. Adding more facilities, as FTAI' becomes amore global presence across EMEA and APAC

I believe the market is missing the mark for many reasons, and this will become more apparent in 2025. Anything can happen in the short-term, but, I will be holding FTAI for many years, unless something dramatic changes my thesis.

Great Resources:

Podcast w/ SVP, Head of CFM Engines: LINK

Podcast series w/ Aerospace Executives: LINK

Philosophy Cap Presentation for Value Accretion in 2021: LINK

Chromalloy 65 Total FAA-approved PMA’s: LINK

High Pressure Turbine PMA Approval: LINK

Muddy Waters Short Report: LINK

InPractise Podcast on FTAI: LINK

Frank on X, who covers + discusses FTAI in detail: LINK

Most Recent January 21st, ‘25 8-K: LINK

Disclosure: At the time of writing, I own a significant position of FTAI in my portfolio. I may add, reduce, or sell my position without notice. This write-up is strictly informative, includes my opinions and does not constitute as financial advice. Please do your own due diligence.

Hello do you have an update on this after earnings?