Deep Dive: Atlas Engineered Products (AEP.V, APEUF) Stock Analysis

A nano-cap gem in an undesirable industry. Long runway for growth, great working capital management, a rollup M&A strategy, and a founder led CEO that inspires confidence.

Disclosure: At the time of writing, I am long shares of APEUF. I may add, reduce, or sell my position without notice. This write-up is strictly informative, includes my opinions and does not constitute as financial advice. Please do your own due diligence.

Merry Christmas Eve, and happy holidays to all! I hope you have a safe, warm time with family this festive season! Now to the writeup…

Atlas Engineering Products Ltd.

Ticker: TSX.V - (AEP.V), OTC - (APEUF)

Share Price: $1.10 (CAD), $0.83 (USD)

Market Cap: $48.95M (USD)

EV:$67.25M (USD)

What I’m Drawn To:

Founder operated business with large insider ownership… CEO owns (6.1%, $3.2 Million USD), with total insider ownership ~19%

Long runway for growth via rollup acquisition strategy… management estimates 220+ M&A targets in Canada alone

CEO has 35+ years of industry experience, and has integrated 8 acquisitions in the last 6 years

Strong organic growth driven by growing product optionality

Great management of working capital, adapting to the known cyclicality of their raw material

Growing ROIC that should continue expanding in the next 3-5 years… complemented by high capital turns

Some purchasing power present in maintaining gross margin profile (even during Covid fall-off in 2020)

Multi-decade runway for growth via expansion into the United States

Risks / Pre-Mortem:

Building projects in Canada take ~3x longer to get approved than in the U.S. and the U.K.

Current elevated interest rate environment discourages home ownership for younger generations, thereby reducing demand for homebuilding projects

Competitive pressures via Private Equity rolling-up M&A opportunities at low buyout multiples

Homebuilders struggling with labor limitations, reducing the number of projects they can take on, reducing Atlas’ order volume

Historically, acquisitions have required share dilution, being a threat to shareholders

Wood trusses being replaced by a composite material / more eco-friendly alternative

Management (particularly CEO, Hadi) choosing to retire / step down (currently 65 years old)

A breakdown in the supply chain / threat to delivering products across Canada / US border

Weakness in the Canadian Loonie (ForEx threat based on strengthening US Dollar)

Business Overview:

Atlas Engineering Products (AEP, or “Atlas”) designs, manufacturers, and sells predominantly roof and floor trusses for residential, multi family, commercial, industrial, and agricultural application. Trusses make up about 75% of sales, with other Engineered Wood Products (EWP) like wall panels, floor panels, floor joists, and windows making up the other quartile. Their end-market customers are primarily single family home builders, with a lesser chunk being multi-family developers, with the smallest segment being tied to specialty building yards (20% of sales).

The company is headquartered in Nanaimo, British Columbia, paying homage to their first flagship factory. Atlas was originally founded in 1984, and sold in 1999 for ~$32,000 USD to current President, CEO, and Chairman, Hadi Abassi. To this day, Hadi still owns ~3.76 million shares, or a $3.2 million USD vested interest in the company. At the time of acquisition, Atlas had one location and was only doing about ~$72,500 USD in sales, but from 1999 to IPO date of 2017, sales grew at a ~30% CAGR, driving an $8 Million run rate. Last year, in 2022, Atlas closed $45.7 Million (USD) in sales, with no sign of slowing down.

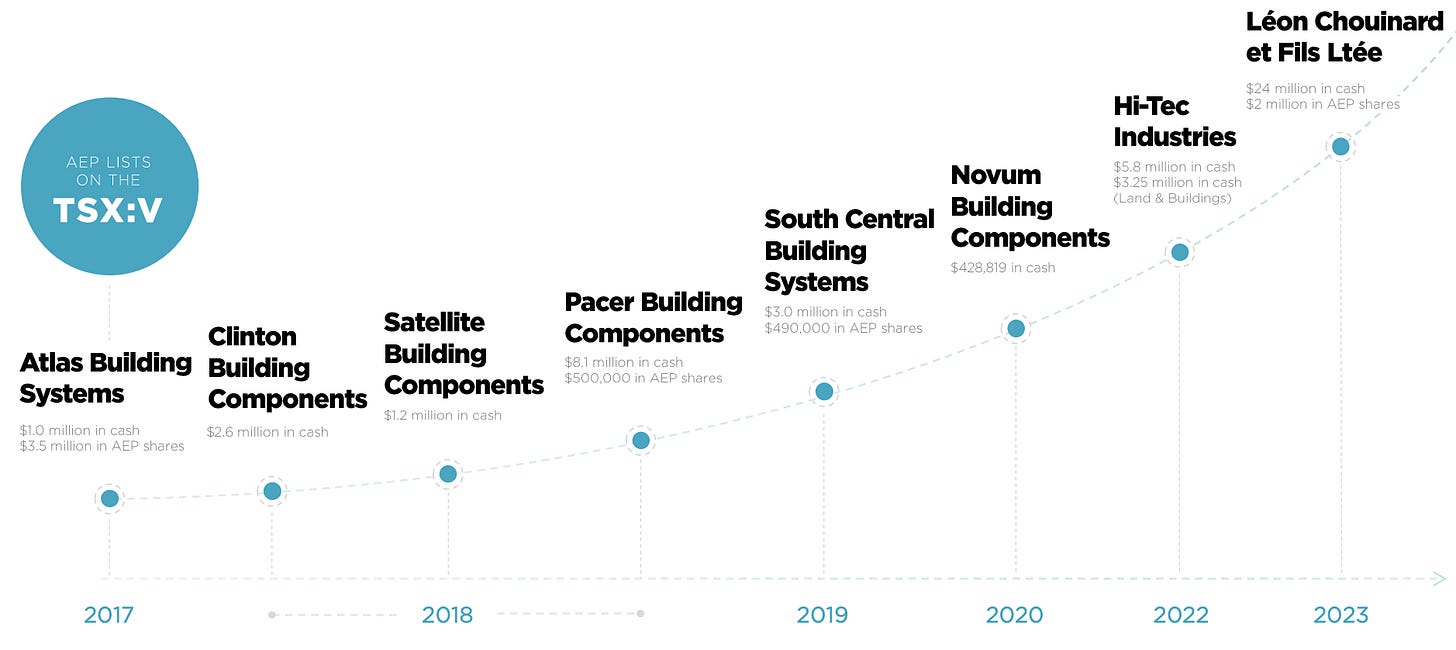

Management has a few levers they can pull to continue scaling. Their motive is to lead with profitable growth, complemented with cross-selling opportunities from their dedicated sales team. The addition of new SKU’s like wall panels have helped them in the upsell process to home builders. However, the segment that excites me the most is their philosophy in consolidating the industry via roll-up style M&A. The industry is highly fragmented, and characterized by 6,000+ Mom and Pop shops, often run for multiple generations. According to Hadi, there are an estimated 220 buyout targets in Canada alone, with sales of ~$3-15 million CAD. The synergies of Engineered Wood Product (EWP) companies enable Atlas to consolidate accounting, admin and other departments. Therefore, enabling them to acquire competitors at 4-5x EBITDA (pre-synergy). Since IPO, Atlas has acquired eight manufacturing plants in total, see graphic (below) for geographic diversity.

Additionally, the image (below) characterizes the timeline in which acquisitions were made since IPO. Also notable, many of these acquisitions included purchase of the underlying land, making the rollups even more enticing.

Product Overview:

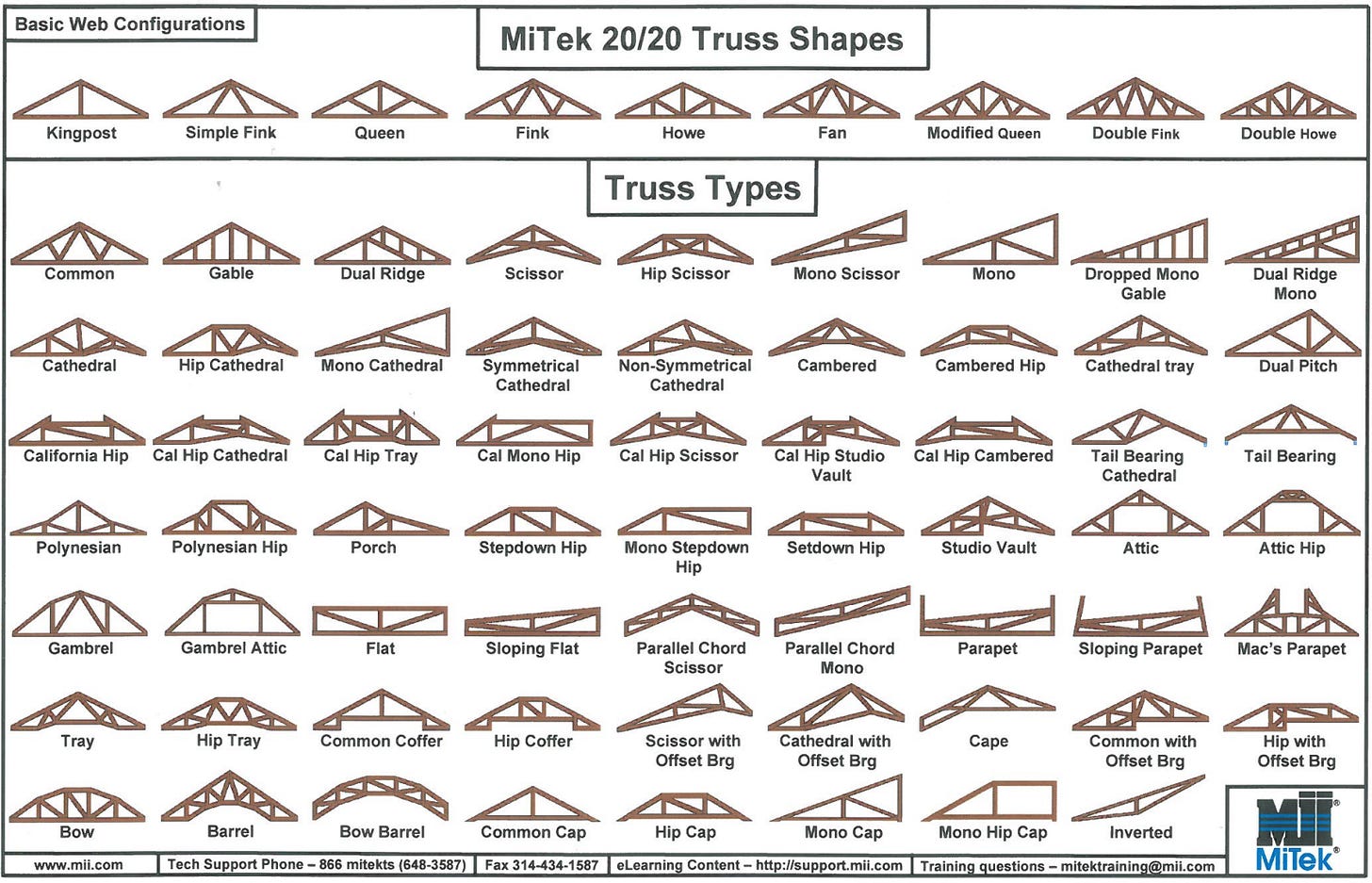

Lets start from the beginning… what is a truss? A truss is a wooden structure that offers support for both framework and aesthetic purpose underneath a roof. Additionally, they can be applied under flooring for functional purpose, as the foundation of a home. There are 80+ differing styles that can be configured to the size of the structure, and the aesthetic appeal (see below). Prior to truss popularization, framers were forced to invest time cutting plywood, hand framing, and hammering nails into a 2x4 to support the weight of a roof. They’re also very cost-conscious alternatives to solid wood rafters, as roof trusses only cost ~$5 a square foot, with floor trusses around ~$4 a square / ft.

Examples of Roof Trusses. Fun fact: MiTek Industries, the vendor this screenshot was taken from is owned by Berkshire Hathaway… meaning I can’t be the only one drawn to businesses of these types!

Trusses can be used on builds that require attic’s, crawl spaces, and structurally complex shapes. They are often found on cranes, bridges, cell towers, and even on the International Space Station. Truss design is conducted using 3D CAD software, where engineers must reduce the potential for vulnerabilities to support the stress of a load. Wood products are then manufactured in climate controlled environments to pull moisture from the wood, reducing shrinkage, and are delivered to the job site prior to installation.

On the other hand, floor trusses (see above), are pre-fabricated to lay under flooring. Floor trusses offer home builders multiple benefits, and are selected for a few core reasons. They are not reliant upon a center support beam, enabling a floor to support the concentrated weight of a kitchen counter, a bathtub, or a balcony. Open pockets in the floor truss ease the setup of HVAC, plumbing and electrical wiring, driving down costs for installation. Also notable, floor trusses are designed and pre-constructed to fit the dimensions of a home, meaning contractors don’t have to make modifications on the job site, reducing installation time. Trusses enable better cost control, as they don’t require steel beams or heavy duty posts. And ultimately, they reduce material waste, making a build more environmentally friendly. For setup, only 2-3 people are required to balance the wooden trusses, and drill them into the framework. A stark contrast to framing and production on-site, which can take an estimated 8-12 weeks to plan, design, build and frame for a ~2,000 square foot home. Choosing to outsource, floor trusses can be custom cut and delivered in a two week window.

For the home owner, trusses enable greater flexibility in remodeling, as interior walls can be knocked down and moved to create a more open-floor concept. Extensions to the home, like balconies, can also be made. Floor trusses are responsible for what gives flooring that trampoline-like give, counter to the feeling of cement. Another benefit, floor trusses don’t shrink, so they’re known to reduce creaking noises and wood warping that can lead to floors caving inward. Despite the simple appearance, the design and construction of a truss requires sophisticated engineering, as compliance with detailed permitting must be met. As a result, home builders are very very brand and reputation conscience to ensure safety issues are met, playing to Atlas’ strong domestic name.

Industry Context:

Atlas estimates the market size for roof trusses at $2 - $2.5 Billion CAD in Canada alone. At a current $54 Million CAD run rate, that means AEP has ~2-2.5% market share in their homeland. As previously discussed, Atlas has brought new products to market, like wall panels, aiming to cross-sell into existing customer bases. Thus why the addition of the L’Chouinard facility was so important, as this factory enhances their addressable market by nearly 4x. CEO Hadi Abassi has made it crystal clear that expansion into the United States is not a question of “if”, but rather “when”. Although this will eventually complicate transport costs, and uncover new competition, new M&A opportunities, and increasing supplier relationships would make for a more robust business overall.

Perception vs. Reality:

Atlas’ stock price faces multiple headwinds based on perception. First off, the security is a highly illiquid Canadian “penny stock”. I’m not a fan of this label, as I could not care less about the stock, but rather, the business that underlies it. However, it trades on the Toronto Ventures exchange (TSX.V), known for more speculative, junior forms of equity. This in contrast to the more well-renowned, Toronto Stock Exchange for senior equity owners, makes AEP quite overlooked. Due to lack of trading volume, shareholders face liquidity issues, which is further exacerbated as insider ownership is around ~20%, making float even harder to obtain. Secondly, international investors have to endure Canadian taxation or purchase the OTC shares under a separate ticker, APEUF.

Given their status as a product supplier to homebuilders, Atlas is grouped in this same bucket. Often, homebuilders are prone to extreme cyclicality given lumber input costs. Although aspects of this association are accurate, I think the market is overestimating the cyclicality given the different levers they can pull to anticipate demand and growth prospects. Another factor that may turn off shareholders is their path to public markets. AEP was taken public via a Reverse Take Over (RTO) with Archer Petroleum. An RTO is the opposite of a “SPAC”, where a private company acquires a public one, using it as a vehicle to gain public funding. Although it’s not a traditional IPO, there’s a negative connotation to SPAC-like offerings (often for good reason), that may influence shareholder perception. Nevertheless, the CEO’s reasoning for going public was rather straight-forward. Once having 80% ownership in Atlas, Hadi sacrificed much of his ownership to take advantage of the consolidation opportunity he saw the industry present. After expanding footprint for many years, Hadi believed he could rollup the sector in tandem with industry tailwinds that would guide high single digits growth into perpetuity.

ROIC Sustainability:

Given the volatility in lumber pricing in any given year, I expected Atlas to be a business with erratic, low returns on capital. However, after integrating acquisitions in the last three years, Atlas has averaged a 28.6% Return on Invested Capital, with minimal fluctuation. Despite some ROIC inconsistencies shortly after their IPO, I wanted to understand whether their operating efficiency was sustainable in the future.

After studying their past decisions, it became clear that they were outstanding managers of working capital. Despite being a low margin business, they’re able to sustain high ROIC, similar to other low margin names like Costco and Murphy USA through very high capital turns. The working capital breakdown (below) addresses how Atlas is able to churn inventory on average over 11x a year.

Additionally, every dollar invested in Net Working Capital has produced an average of ~$10 in sales since 2018 (see below).

The second arm of strong ROIC is found in the gross margin profile. I consider this lever to be a competitive advantage, so you can find this mentioned in the next section. When an acquisition is being integrated, AEP doesn’t need to employ a great amount of capital, as integrating new facilities come with synergies like consolidating departments, ERP systems, and workflows. As a result, these synergies are enhanced from buying in bulk, which pricing should become more competitive with time, as their reputation benefits from their increased scale across Canada. Additionally, cross selling opportunities arise with an expanded book of business, as each acquisition brings a new set of customer relationships, often grandfathered in with previous management.

Competitive Advantages:

Atlas demonstrates a few characteristics that lead me to believe that they have dominant, monopoly-like positions in their end markets. As previously addressed, their strong ROIC is partially a byproduct of their above average gross margin profile. From 2018-2020, gross margins averaged 22.3%. This grew to an average of 31.4% from 2021-2023, mostly from normalized lumber pricing. Despite appearing inflated, I believe margins will not dip more than 2-4%, as material pricing does. However, 3-4 years down the line, I wouldn’t be surprised if they re-expanded due to scale, cost control, new product offerings, and a strong national brand.

Over time, Atlas has proved their ability to leverage greater economies of scale. As demand for housing increases, they continue to scale production, and increase order size, helping to enhance relationships with local suppliers. Thus, driving down their cost of goods, and expanding their gross margin profile. Also notable, I feel that the expansion in gross margins has more to do with operational efficiency, and corporate intangibles, than it does lumber pricing. Additionally, the scale at which they’re operating has enabled them to hire a dedicated sales team, providing them with tools to enhance AEP’s local brand, something that Mom & pop vendors can’t afford. Finally, their scale enables them to reinvest back in their business. In particular, Hadi has talked about their ERP & backend system, that helps manage the sales process, where competitors can’t afford to invest $150k-$200k to expand their footprint.

Reputation and economies of scale are also seen within their inorganic growth strategy. Atlas benefits from buying out Mom & Pop shops as owners look to retire. As young generations are raised in the digital age, most take no interest in running a wood products business. Therefore, Atlas is one of the first calls when owners are looking to exit. Most EWP companies employ a small team that they’ve worked with for years. As a result, owners want to exit knowing that their employees will be taken care of. Given the growth that Atlas is achieving, owners are granted peace of mind knowing that their employees will have work in the future. This strategy is very effective. However, it’s only effective as management doesn’t get involved in bidding wars, choosing to interact with owners personally, enabling them to buy competitors at 4-5x EBITDA (pre-synergy). This dynamic was likely emulated from Buffett or Mark Leonard from Constellation Software. Although multiples paid for competitors are inexpensive, without the patience to wait for the right deal and the right price, this strategy wouldn’t be as compelling. Thankfully, Hadi Abassi’s diligence in M&A is what reinforces my belief that he’s a wonderful manager of shareholder capital.

Another noteworthy advantage is Atlas’ buying power and ability to shelter their margin profile in time of slowdown. Volatile lumber prices make maintaining gross margins difficult. However, in an interview with management, CFO, Melissa McRae discussed how they keep margins within a range. When lumber prices are abnormally high or low, Atlas is able to tailor a margin of safety to sit on their end-product to ensure that profitability doesn’t slip. Impressively, this has not deterred home builders from purchasing through Atlas. Furthermore, trusses are manufactured from start to finish in house, offering Atlas greater cost control, that should drive higher margins in the future. For products like beams and floor joists, that are designed and cut in-house, but aren’t vertically integrated, they make up a smaller percent of sales.

Regarding their buying power, Atlas’ ability to control prices has improved with time, as they’re able to update pricing quotes the day of delivery, instead of honoring a 30-90 day advance, waiting at the mercy of macro factors. This is another benefit of offering end market pricing in bulk, a trait that wouldn’t be possible without the relationships from suppliers. Additionally, the acquisition of L’Chouinard reduces their reliance on going to a 2nd hand distributor for wall panels, enabling further buying power in the production process. With these relationships, comes the flexibility to manage threats in a supply chain collapse more effectively. This also enables them to strategically move product from facilities to more favorable markets when selling into the United States. Given each manufacturing plant, with the exception of L’Chouinard is strategically on the US Canada border, there’s a massive untapped opportunity for cross-border selling.

Barriers to Entry:

Another underrated aspect of this business are the substantial barriers to entry. Given Atlas’ products are planned prior to a build, and require approval upfront, they gain access to the build plans before any part of the structure is designed or installed. This timing advantage gives them the ability to cross-sell wall panels and windows, making them a consolidation play for homebuilders, a feat that smaller vendors cannot afford. Additionally, in an interview, Director Paul Andreola discussed the scale advantage in meeting homebuilder project needs. Few wood products providers in Canada are able to meet the inventory requirements to satisfy the request of multiple projects. As a result, large homebuilders are able to pay upwards of $300k in advance for multiple projects worth of working capital, putting AEP in rare air.

Geographic Location & Conclusion:

The wood truss industry is impacted by different geographies dictating margin profile, revenue seasonality, and home builder projects. According to CEO Hadi, there are three cities that makeup the largest havens of capital in Canada: Toronto, Montreal, and Vancouver. Given strong immigration trends and variable supply / demand dynamics, these are the most volatile markets for home builders to take on single family projects. As a result, AEP is not involved in these regions, as they look to reduce cyclicality in home demand, and reduce competitive pressures. Instead, they concentrate on rural areas where housing is cheaper, and customers are more economically mature. Their target consumer typically has less disposable income than the major metros, however, sales are more predictable based on migration and consumer demand.

Despite their efforts, Atlas isn’t fully insulated from the threat of variable geographies. In particular, each providence has different population growth, and can be manipulated by factors like weather. Everything from unemployment rates, the labor market, housing market, interest rates and mortgages rates muddy the process of scaling. Additionally, political pressures, taxes, new ESG initiatives, and changing bylaws present each region with their own complications. Despite high interest rates and unfavorable macro, Atlas’ has not faced many road bumps, as demand is still strong in their end markets. Historically, when lumber prices were down 60%, 60-70% of sales variance was attributable to the lumber price itself. This presents an issue, as AEP can be occasionally at the mercy of what the market is paying for raw material. However, Atlas’ presence across the entire Canadian land mass makes them the premier player to support the projects of home builders, no matter the complication, or backdrop. Despite being a business in an otherwise unattractive industry, Atlas will be a massive beneficiary in the coming decades to accommodate migration and demand in the rapidly growing Canadian markets.

Thank you for reading! Here are a few great Resources to learn more:

Nice write up. Fellow shareholder since 2022

Are you still writing?

Great job!

Banash, valuation will take care of itself, i am more focused on being right in the company and management and the adressable market. Rolls ups are hard to value as they can increase value overnight with any m&a which wasnt known before. As long as they keep executing i am very fine holding this to oblivion. Business takes time, i am sure management has a plan to withstand the winter snd be ready for spring rally here.

Mortgage rates keep declining. Wish to see rates follow.